1. FileInvite

FileInvite mechanizes the system of collecting AML files from the customers with a simple procedure and on a steady interface. All that must be accomplish is to create and send a FileInvite with the required information. The client then uploads the files to a steady portal where you may approve or decline the statistics that have been submitted. With FileInvite, reminders can be set, and the AML Solutions and AML structures can sync with cloud storage like Google Drive. They even have a free version available.

2. ML Verify

ML Verify is a cloud-primarily based anti-money laundering and consumer due diligence platform, with a purpose to take benefit of technology to simplify the routine and help businesses to integrate customers in a powerful manner.ML Verify offers with a custom branded consumer portal, electronic ID verification, computerized PEP and economic sanction checks, and more suitable due diligence to mitigate the cost and resources earmarked for AML compliance significantly.

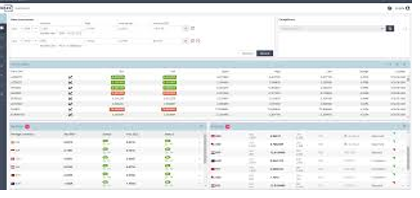

3. Biz4x by 4xLabs

Biz4x by 4xLabs was established in 2012, is utilized by Currency exchange, overseas exchange, cash services companies, money changers, foreign exchange bureau, accountants, auditors, lawyers, company secretaries, financial institutions, and fintech. Biz4x provides the facilities money services companies, professional services, fintech, and financial institutions come to be more efficient, relevant through access to stay market data; compliance features a completely audited transaction management system.

4. SAS

SAS Anti-Money Laundering is a Cloud-primarily based anti-money laundering answer that gives tools for records management, and suspicious hobby monitoring. SAS was designed for banking and financial institutions that allow manipulation of suspicious interest monitoring, reporting, and alerts.

SAS Anti-Money Laundering is a Cloud-primarily based anti-money laundering answer that gives tools for records management, and suspicious hobby monitoring. SAS was designed for banking and financial institutions that allow manipulation of suspicious interest monitoring, reporting, and alerts.

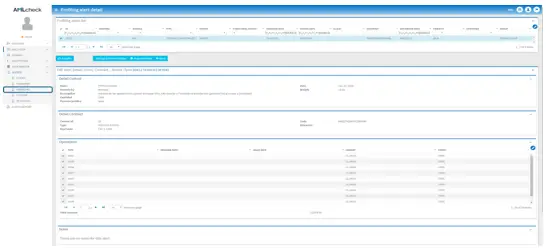

5. AMLcheck

AMLcheck is used for regulated entities like credit score entities, insurance organizations, promoters, and actual estate agencies brokering organizations and stockbrokers, change offices, jewelers and gambling casinos. AMLCheck, by way of RiskMS, is a complicated technological solution that enforces the legal requirements using identifying people or assets in the onboarding process, scoring the clients profile from the database, based totally on the available information, and making post-execution analysis of the transactions using defining manipulate scenarios to come across suspicious behavior.

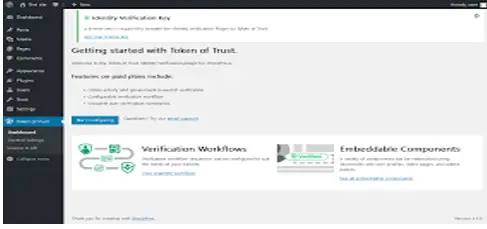

6. Token of Trust Identity Verification

Token of Trust Identity Verification was established in 2015, is an online merchant coping with high-risk eCommerce, AML compliance requirements, consumer information, privacy laws, and worldwide users. Trust Identity Verification using Token of Trust – a global platform that gives merchants with a collection of identity verification equipment such as Document Checks, Facial Verification, Phone Verification, and Online Social Network Verification, etc.

7. AML Manager

AML Manager was founded by Fiserv, one of the few AML Solutions and systems that can be installed on Mac combines technologically advanced features and a user-friendly, statistics-wealthy interface with powerful prevention and tracking tools. It makes the research of suspicious activity easy and extra effective. Based on peer group evaluation and rules, the smart transaction monitoring in AML Manager uncovers most effective those signals with the best diploma of threat, which appreciably minimizes the variety of fake positives.

8. Avid AML

Avid AML accepts as right with cutting edge generation takes the pain away from Anti-Money Laundering. Avid AML allows you on what wishes recognition without pressure and elevated compliance costs. Simplicity Avid AML eliminates clutter so you can control your Anti-Money Laundering wishes with simplicity. Avid AML considers in making AML compliance clean and low-priced so corporations can guard their commercial enterprise against cash launderers.

9. KYC Portal  KYC Portal specializes in automating the back-workplace of any due diligence process. It permits you to define and manage all your regulatory and policy requirements within the device, and it then provides the operational ability to automate and manipulate the entire manner from on-boarding relationship control all through the automation of ongoing aspects of KYC which includes risk-primarily based approach, reporting, record requests, automatic risk-based questionnaires, etc.

KYC Portal specializes in automating the back-workplace of any due diligence process. It permits you to define and manage all your regulatory and policy requirements within the device, and it then provides the operational ability to automate and manipulate the entire manner from on-boarding relationship control all through the automation of ongoing aspects of KYC which includes risk-primarily based approach, reporting, record requests, automatic risk-based questionnaires, etc.

10. Risk Scree

KYC Global Technologies is a software organization based totally in Jersey that gives a piece of software referred to as RiskScreen gives business hours support. RiskScreen capabilities education through documentation and in character sessions. The RiskScreen software suite is SaaS and Windows software. Risk screen is AML software and includes features including behavioral analytics, case management, compliance reporting, research management, PEP screening, hazard assessment, SARs.