Science and technology are growing and getting newer versions in our daily lives. The innovations and growth that these fields are undergoing are beyond a human’s imagination and thinking. The online technologies too have been useful for humans in making things at ease and more quickly. This way the trend of opting for online cash transactions is very resourceful for people. Let us look at the ten reasons why people like performing money transactions and other bank options through online modes.

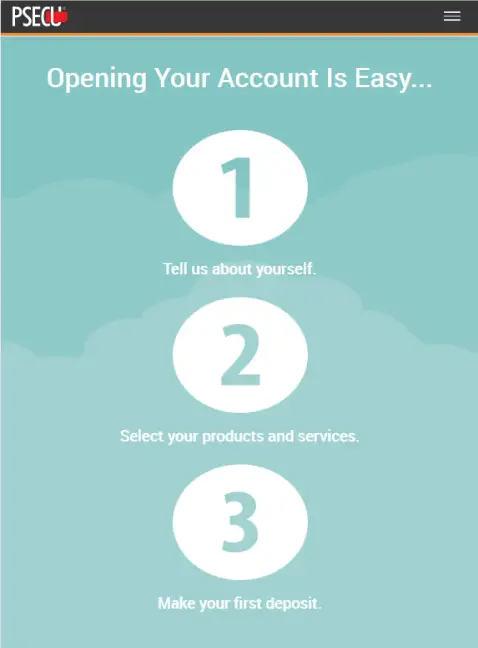

1. ACCOUNT OPENING

Online banking will majorly save your time in opening a fresh account. The user has to do a few simple steps to open his or her bank account with proper details for filling in the forms. Every bank will have separate norms for filing, and this will be easily guided by the banks’ page the user views.

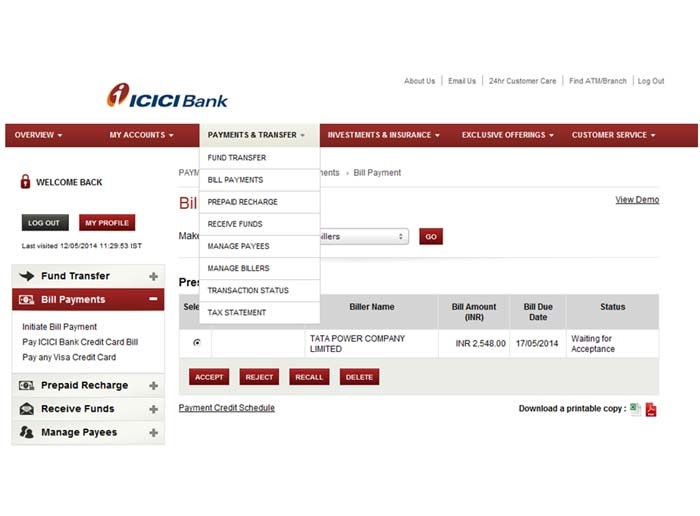

2. DIGITAL BILLS

Since E-banking is primarily through internet mediums the need to receive paper statements or other physical forms of bills is reducing. Also, this has the advantage of not losing your bills whenever you are in need of it since you have readymade electronic transactions in your phone or system!

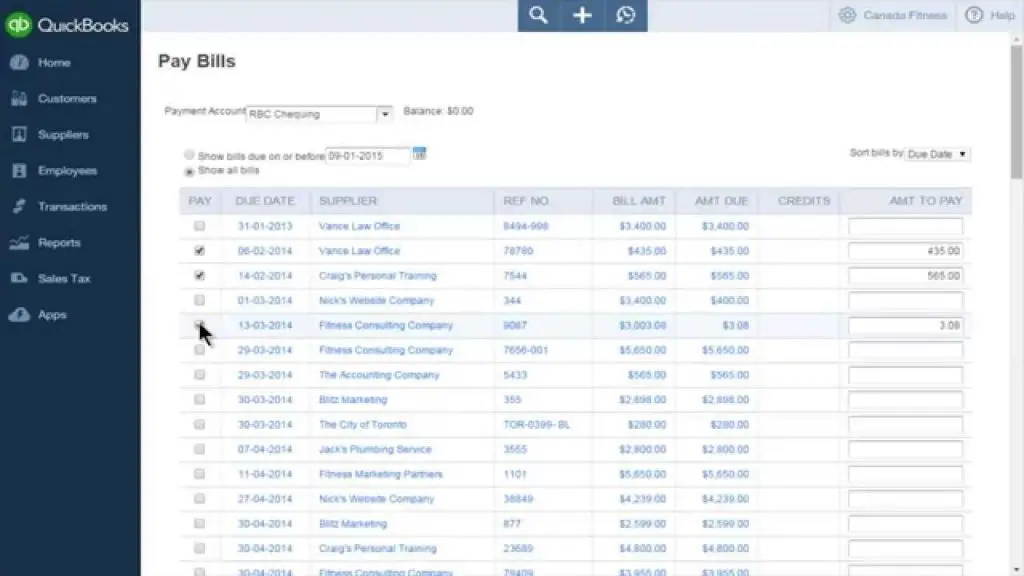

3. AUTOMATIC BILL MODES

One of the salient features of E-banking is that it helps the user to do a bank transaction or pay the bill of something without your manual work and time cost. The user has to pick the automatic bill payment option and the user in no time pays the bills of all the listed things at the right time!

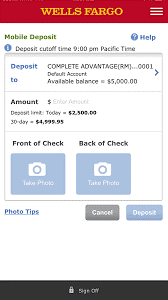

4. CHEQUE DEPOSIT

Mobile applications are available for so many purposes, and E-banking is also possible for a particular bank through few apps. There is no need to go to a bank directly to send checks; the user may need to click pictures of a check’s front and back and send it to the respective bank via the app downloaded from Playstore!

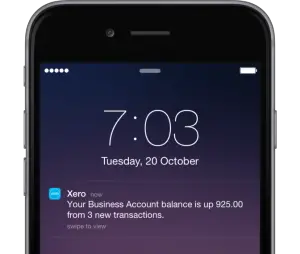

5. REGULAR NOTIFICATIONS

No one likes spam, but if regular messages are coming for banking then it is a life-saver! Online banking has this option of giving your regular and close supervisions on your payments, balance details, and other cash related elements in your mobile or system.

6. CONVENIENCE

As the name says, online banking is the use of banking systems from anywhere you are currently. Convenience means that you can share your money, pay bills, etc. from anywhere at your comfort. Travel expenses, time, and energy all are in savings!

7. REPORT TOOLS

Some branches of banks even allow the user to check on their payments which were made previously. Reports tools are not possible in few banks since they do not show the history of payments. Online banking makes it possible for almost all banks to show the customer’s details of their money and also help them place it in appropriate categories like the emergency, medical, school, etc.

8. INTEGRATION

When the user has an online bank account, then he or she has the feature to connect other software of their gadget, making things easier and quicker the next time they are in need to do an online bank procedure.

9. EASY ACCESSIBILITY

One of the key features of online mode of banking is that the user can perform the banking process not only through a single device but with the support of “logging in, the user can do things from any gadget available!

10. NAVIGATION

The customer is easily able to use the system of banking through an app or online bank site, with the help of proper rules and norms guided by the bank’s website or application. Hence, online banks have the ease of control and use.