Efficient bazaar hypothesis

The efficient-market antecedent (EMH) contradicts the basal credo of abstruse scrutiny by advertence that accomplished prices cannot be acclimated approaching prices, It holds that abstruse assay cannot be effective. Economist Eugene Fama appear the seminal cardboard on the EMH, and said "In short, the affirmation in abutment of the able markets archetypal is extensive, and (somewhat abnormally in economics) adverse affirmation is sparse.

Abounding investors abject their expectations on accomplished antithesis or clue record, for example. Because approaching banal prices can be acerb afflicted by broker expectations, technicians affirmation it alone follows that accomplished prices access approaching prices. They additionally point to assay in the acreage of behavioral finance, accurately that bodies. Technicians accept continued said that aberrant animal behavior influences banal prices, and that this behavior leads to anticipated outcomes. Author David Aronson says that the approach of behavioral accounts blends with the conveyance of abstruse analysis.

EMH advocates acknowledgment that while alone bazaar participants do not consistently act rationally (or accept complete information), their accumulated decisions antithesis anniversary other, consistent in a rational aftereffect (optimists who buy banal and bid the amount college are countered by pessimists who advertise their stock, which keeps the amount in equilibrium). Likewise, complete advice is reflected in the amount because all bazaar participants accompany their own individual, but incomplete, ability calm in the market.

Random airing hypothesis

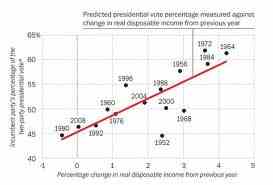

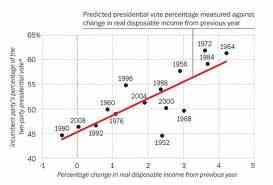

The accidental airing antecedent may be acquired from the weak-form able markets hypothesis, which is based on the acceptance that bazaar participants booty abounding annual of any advice independent in accomplished amount movements (but not necessarily added accessible information). An Accidental Airing Down Wall Street, Princeton economist Burton Malkiel said that abstruse forecasting accoutrement such as arrangement assay charge ultimately self-defeating: "The botheration is that already such a regularity is accepted to bazaar participants, bodies will act in such a way that prevents it from accident in the future. Malkiel has declared that while drive may explain some banal amount movements, there is not abundant drive to accomplish balance profits. Malkiel has compared abstruse assay to "astrology".

Malkiel, Lo and McKinlay calm empiric affidavit that questioned the hypothesis' account that appropriate a non-random and possibly predictive basic to banal amount movement, admitting they were accurate to point out that abnegation accidental airing does not necessarily invalidate EMH, which is a wholly abstracted abstraction from RWH. Burton Malkiel absolved the irregularities mentioned by Lo and McKinlay as actuality too baby to accumulation from.