What Is e-invoicing?

An e-invoice, or electronic invoice, is a visual document created by a dealer and buyer and confirmed by the government tax portal. E-invoicing is a hypothetical system in which business-to-business (B2B) invoices are visually generated in e-invoicing format and authenticated by the Goods and Services Tax Network. This method guarantees that early invoices to the GST site follow a general structure.

How Does e-invoice Work?

E-invoicing consists of two parts: the collaboration between the companies and the IRP and the partnership between the IRP, the GST/E-Way Bill systems, and the purchaser.

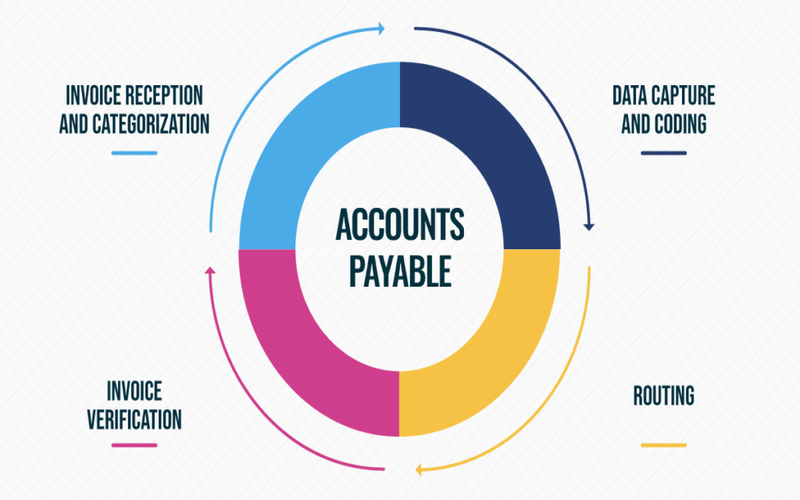

E-invoicing simplifies financial operations by allowing for systematic management of accounts payable (AP) and receivable (AR) via visualized workflows in user and supplier invoicing.

Facilitating E-Invoicing For Businesses

Businesses will have the following facilities by using e-invoice beginning by GSTN-

- E-Invoice resolves and fills a prominent gap in data reconciliation under GST to minimize mismatch errors.

- E-invoices made with one software can be read by another, promoting interoperability and reducing data entry errors.

- Actual-time tracing of invoices prepared by the supplier is allowed by e-invoice.

- Backward blending and automation of the GST return substantial procedures. The related details of the invoices would be auto-populated in the multiple returns, especially for creating part A of e-way bills.

- Tax control audits/surveys are less likely as necessary information is available throughout the transaction phases.

- Small businesses benefit from easy access to formal credit options, including invoice discounting and financing.

- Improved user relations and more opportunities for small businesses to conduct business with bigger companies.

Challenges Of e-Invoicing Under GST

- First Implementation Costs

Implementing e-invoicing systems and integrating them with current auditing or billing software may incur upfront expenditures. Companies must invest in appropriate software, company, and training to transition to electronic invoicing.

- Technical Needs:

E-Invoicing needs a flexible internet connection and united software systems. Minor businesses or those performing in remote areas may face challenges meeting these method needs.

- Adoption Challenges:

The transformation from standard paper-based invoicing may need adjustment and training for workers. Resistance to change and the need to educate suppliers and users about the latest process can pose adoption challenges.

1. Creating A Unique IRN

The IRP will construct a hash parameter depending on the seller’s information, including GSTIN, document type, document number, and fiscal year. The IRP will next check if the same invoice exists in the Central Registry, and if there are no duplicates, it will insert its essential and QR code into the invoice’s JSON data. The IRP’s hash will be the Invoice Reference Number (IRN) for the e-invoice.

2. Seamless Account Reconciliation

E-invoicing can assist in bridging the gap in data reconciliation to minimize mismatch errors and data entry issues. It will also be possible to trace invoices prepared by the supplier on an actual-time basis, which minimizes audits by the tax authorities since the needed data will the pre-population of GST to be retained, which will minimize reconciliation-relevant problems.

3. Quicker Accessibility Of Genuine Input Tax Credit

Primary calculations while filing GST retain frequent conduct to issues concerning under or over-claiming of input tax credits. A company is authorized to pay this amount for the tax already spent on the product. Any differences in the insisting of ITC can result in enormous losses for a company and would also cost the business holder additional to fix the issues. Because information is available in GSTR-2 in real-time, using e-invoicing, the purchaser’s ITC eligibility is checked.

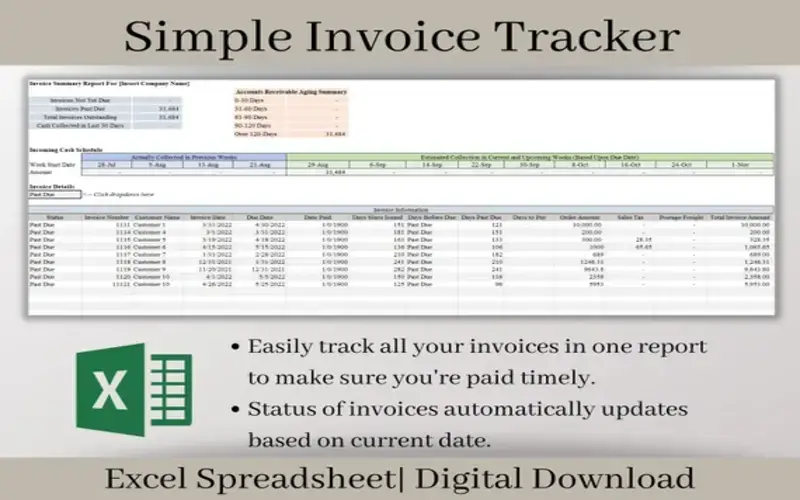

4. They Are Simply Tracing Invoices

When using the e-invoicing system, it is simple to see where the e-invoice goes in real time. The status of the invoice, whether approved, unauthorized, or pending by the client, can also be looked at.

5. It Helps Monitor An Eye On Your Revenue

There may be moments when you are uncertain if your company is economic. That’s how e-invoicing can assist you in maintaining track of your incomes and pending incomes. Within a minute you may monitor how many bills are loading, fished, or cancelled.

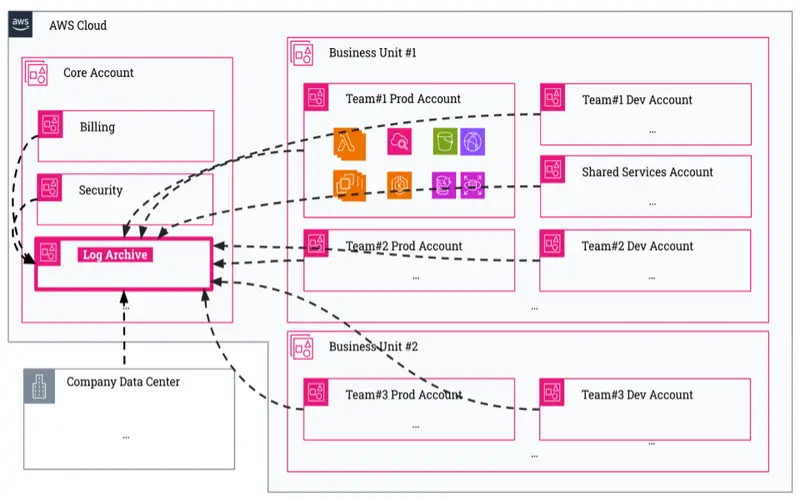

6. Centralized Archive

E-invoicing also allows for efficient record-keeping and archiving of invoices, making it more accessible for businesses to organize their financial documents and meet regulatory requirements. It also minimises space requirements and the utilisation of physical storage materials. As part of the country’s specific e-invoicing requirements, the law establishes a short time during which e-invoices should be documented.

7. E-invoicing Pays For Itself

Many of the innovations that firms develop are methods, but it may take some time to implement a return on investment, if at all. According to Gartner’s “Top Priorities for Finance Leaders in 2022” research, “although digital spending has increased, many CFOs are concerned about the returns on these investments. The same report highlighted eight critical areas of “digital business evaluation” that CFOs should be looking at. Of these eight, e-invoicing plays strongly in five, decreasing, costs through automation, and enhancing employee flexibility.

8. Technical Compatibility

E-invoicing requires businesses to have compatible systems and software to process invoices electronically; however, achieving technical agreement can be difficult, particularly for small businesses that may not have the resources to invest in the latest innovation.

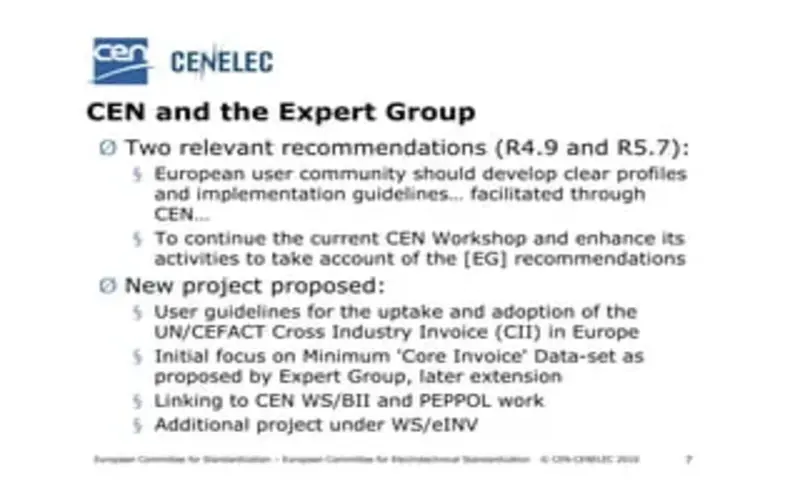

9. Standardization

There are multiple e-invoicing traditional formats used around the world, which makes it a problem for businesses to convert invoices with international partners.

10. Protection And Fraud

E-invoicing necessitates converting sensitive financial information, which can lead to cyber-attacks and fraud. Companies must ensure that they have harsh security measures in place to secure their financial data.