Hello buddies,

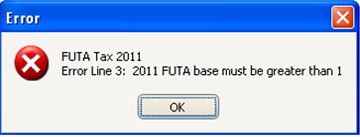

FUTA software is always my first choice for checking payroll calculation, but during the calculation of the payroll checks, an error message appears on the screen.

Does anyone know what it is? Is there any error of data or information that I inputted for the employees? Any kind of help will be appreciated.

Error:

Error

FUTA Tax 2011

Error Line 3: 2011 FUTA base must be greater than 1

FUTA payroll software “error line 3”

FUTA shouldn't be allotted as a deducting because, as of the time of this composition (Feb 2011), employees don't pay a contribution of FUTA. Since tax jurisprudence occasionally alter it is usable as a deducting for conceivable future apply only.

-

To clear the trouble go to the Employee Withholdings sieve > click onetime on FUTA to choose it > click erase.

While almost states don't demand employees to pay a contribution of SUTA, others do. Check: FUTA & SUTA grades.

Whenever your state doesn't deduct SUTA from employees attend the Employee Withholdings concealment > click one time on SUTA to choose it > click erase.

Whenever your state does deduct SUTA from employees then the trouble is the Employee earnings basis and Employee's contribution (percentage) haven't chivied up on the School choices concealment.